Terms & Conditions

These Terms & Conditions are agreed by the Customer (hereinafter referred either as “Customer” or “Remitter”) with Redha Al Ansari Exchange (hereinafter referred either as “RAE” or “Redha Al Ansari Exchange”). The Customer acknowledges that he/she has read the below terms and conditions related to the different services the Customer requested (“Services”) and that he/she has the necessary knowledge to understand the consequences of those Terms and Conditions.

Therefore, the Customer acknowledges and undertakes the following:

- PRODUCT- Remittance: Payment instructions will be transmitted by swift/telegraphic transfer/online transfer/Bank Transfer/ tested telex/tested fax/tested/ email/any mode of funds transfers upon receipt of cash or on realization of cheque in full (including all charges), through the respective Correspondent Banks/Agents. In the absence of any specific instructions to the contrary, payment instructions shall be honoured on value dates (after applicable deductions, if applicable), through the respective Correspondent Banks/Agents and paid in the currency of the destination country.

RAE shall not be liable for any delayed payments/non-payments/any loss caused by technical/electronic failure/illicit acts/by any action/inaction/negligence of the Correspondent Bank or its Agents or order of any of Government Agency/Court/ by any third party or as a consequence of any other cause or circumstances beyond RAE’s control.

Under all circumstances, should RAE be held liable for any action/inaction/negligence, the liability of RAE will be limited to the gross amount of transaction duly realized/collected by RAE. RAE reserves the right to demand valid id proof of remitter/beneficiary and proof of source of funds etc. as and when required to execute the transaction. It is the sole responsibility of the customer to provide correct and up to date information or documents.

- The exchange rate quoted or displayed by RAE through any means including but not limited to telephone, website etc. is an indicative rate only and is subject to change as per market fluctuations. Accordingly the rate applied on the transaction will be the rate that is prevailing on the day and time when the transaction is initiated.

- All types of transactions conducted by the customers are subject to Central Bank of UAE regulations as well as local, Federal and International Laws.

- In the event of foreign currency exchange transactions, currencies once sold or bought cannot be returned/refunded. Customer must count the money before leaving the Cashier’s counter. Neither RAE nor its employees will be held liable for any claims or shortages thereafter.

- Redha Al Ansari Exchange reserves the right to recover any excess amount paid due to errors and omissions.

- In case the sender is a Corporate, refunds or amendment will be initiated only after receiving authorization letter signed by the authorized signatory of the company and the amount will not be refunded or paid in cash under any circumstances. The refund will be made through Cheque favouring the corporate name of the sender.

- RAE holds the right to refuse any Transaction or limit the amount to be transferred If we feel that the transaction;

▪ Conflicts with the Law, Regulation or other duty and responsibility that is applicable to us.

▪ May expose us to action from any Government or Regulator or linked with fraudulent or illegal activity.

▪ The details provided by customer are incomplete, incorrect, unauthorized or forged.

▪ Any other reasons or updates/advisories comes from the competent authorities and RAE internal policy/decision shall also applicable.

- For transactions paid by cheque, the cheque must be current dated. Transaction shall be processed subject to cheque realization. In case the provided cheque is dishonoured or rejected for whatsoever reason, the customer agrees to settle the full amount in cash along with any variations in the currency rate along with all other charges whatsoever applicable. Further, RAE reserves the right to cancel the transfer and take legal action against the remitter/customer and hold the remitter/customer responsible for all expenses involved in connection with the transaction.

- In case of any instant money transfer services (send & receive) the terms and conditions of the service provider will be applicable. For further information please refer to the service providers website (Eg. Western Union, Instant Cash, Transfast etc.).

- To maintain safety/privacy/security of the transaction/s customer should not disclose the information about the transaction including but not limited to reference number, value of transfer to any other party other than the intended beneficiary.

- RAE is an agent for various third party organizations operating in UAE for which cash is collected at our end which includes Utility bill payments, Air ticket payments, Labour guarantee issuances, Credit Card bill payments, Investment Services etc. If a Customer avails any such service/s of those companies through us, the terms and conditions of those companies shall also be applicable for such transactions. RAE has no liability towards any related services and the third party organization/s will be fully liable for the completion of its services.

- In case of online requests/transactions, the value of the transaction including applicable charges must be paid within 4 hours by the customer to any of RAE branches or it will be cancelled without notice.

- Additional charges may apply by the banks in case of paying the transaction value through credit/debit cards or bank channels.

- REFUNDS –Telegraphic Transfer/Instant Money/Online/swift/Tested telex/tested fax/all types of remittance services (Currency Exchange transactions are excluded): Refunds will be effected as per the procedures of RAE and shall only be honoured should RAE at its own discretion deems that such refunds must be made. The exchange rate for such refunds will be applied based on the applied rate on the date of issue or the prevailing buying rate, whichever is lower after deducting all applicable charges.

- Beneficiary will be credited by the bank based on the account number and/or IBAN number only as per the regulatory guidelines wherever this condition is applicable.

- In case of remittance transactions the back end charges shall be applied by the Correspondent/ Intermediary/Beneficiary Bank/Agent as per their Terms & Conditions where RAE will not have any control on it.

- Amendments or discrepancies on payment instructions shall be entertained only before transfer of funds from RAE to the Correspondent Business partner/s.

- In case of any remittance transaction amendments, the actual customer must visit the branch and to submit the original transaction receipts and related application forms. The change of beneficiary details will be possible only after receipt of status confirmation. Under any circumstances the amendment shall be made only after obtaining the confirmation from the Correspondent/Intermediary/Beneficiary bank (whichever is applicable) that the funds are not parted/credit to the original beneficiary account. Any types of charges applicable in relation to the amendment shall be the sole responsibility of the customer/remitter.

- Subject to the Terms and Conditions mentioned above, all discrepancies / claims / cancellations / refunds shall be entertained only if the original RAE’s receipt is presented by the actual customer/remitter. Under all circumstances, should RAE be held liable for any action/inaction/ negligence, the liability of RAE will be limited to the gross amount of transaction duly realized/collected by RAE.

- Transaction is deemed to have been accepted by the customer/remitter when the receipt is signed.

- KNOW YOUR CUSTOMER & ANTI MONEY LAUNDERING REGULATION (KYC & AML): RAE strictly adheres and follows to the KYC and AML norms laid down by its regulators and other regulatory bodies. RAE is not responsible for any transaction being on hold/blocked by the respective regulatory authorities at the originating and/or destination country. The Customer shall not commit any illicit act that is deemed in breach of those regulations and shall indemnify and keep RAE indemnified against any such breach/es.

- AML DECLARATION: By signing this application document/Terms and Conditions, the applicant represents, warrants and undertakes as follows:

- All transactions are genuine & legal and would produce documents, when demanded for any queries, evidences, proof or clarifications, as required by any regulatory authorities/bodies.

- The identity and address of the parties in the transaction including their legal entity are confirmed and the funds involved in the transaction are not generated out of or used for any money laundering purposes or funding any terrorist activities or any other illegal purposes.

- UNDERTAKING: By signing this document/Terms & Conditions, the applicant/customer hereby undertakes that all the information provided above in respect of our identification/KYC, KYCC/details of beneficiary’s bank account/address are true and correct to the best of our knowledge and beliefs and further undertake to notify RAE of any changes in the authorized officials or signatories.

- INDEMNITY: The Customer and/or any other applicant hereby indemnifies and keep indemnified RAE and all RAE’s Staff/Officials/Managers/Partners/Legal heirs/Successors/ Directors from any financial loss, damages, claims, demands, legal cost and expenses for carrying out any Service based on a letter of instruction presented either in original letter or by fax or photocopy along with or without cheque or draft or manager cheque favouring RAE.

- FACSIMILE AND EMAIL INSTRUCTIONS: The Customer authorizes RAE to act on and execute facsimile orders/Email orders and instructions of all transactions made through such means. The Customer acknowledges that such means could be subject without limitation to system failure, illicit acts, fraud and hacking and that it is impossible for RAE to verify the genuineness of the signatures appearing on facsimile orders or genuineness of Email orders. Any facsimile order or Email bearing the Customer’s name or company name shall deem to be issued by the Customer and considered as official instructions to RAE.

- CONDITIONS: I/We, agree to abide by all the rules, regulations, terms & conditions presently laid down and also amendments introduced from time to time governing by RAE.

- GENERAL WAIVER: The Customer acknowledges that RAE acts as an intermediary and cannot be held responsible for any action/inaction/negligence related to any third party including without limitation Correspondent Bank/s, Beneficiary Bank/s, Agent Business partner/s, system failure, hackers, etc. and the Customer hereby waives any claim/right the Customer may have in relation to such action/inaction and/or negligence.

The Customer also acknowledges that any correspondence through electronic means may be subject to illicit acts such as but not limited to hacking, system failure etc. therefore RAE cannot be held responsible for verifying authenticity, genuineness, accuracy and completeness of any correspondence made through electronic means. The Terms and Conditions of RAE is subject to change without notice and it will be the sole discretion of the RAE management.

Terms & Conditions For Buying & Selling of Currencies:

1- Buy and sell of Currencies are subject to rules and regulations of the U.A.E. Central Bank

2 - Currencies once sold or bought cannot be returned.

3 - Please count your money before leaving the Cashier's counter. No responsibility will be taken by this company afterwards.

4. This company reserves the right to recover any amount paid due to errors and omissions.

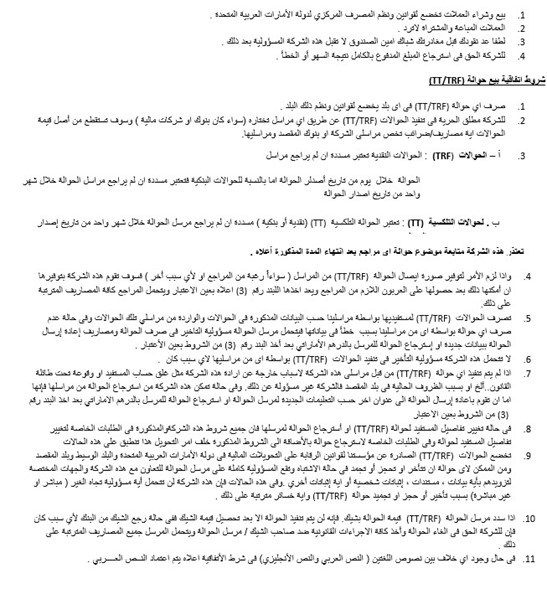

Terms & Conditions For Selling Transfers (T.T/TRF):

1 - Payment process of any Transfer (T.T. /TRF) is subject to rules & regulations for the country of destination.

2 - This company reserves all rights to execute transfers (T.T/TRF) via any of its correspondents (Banks or Financial Institutions). All applicable charges / taxes by its correspondents or beneficiaries Banks and / or Intermediary Banks will be deducted from the principal amounts of transfers.

3 - a-Transfer (TRF): Transfers will be considered as paid unless reported otherwise by the remitter within 15 days for Cash Collection transfers ( non A/C holders), and one month for Bank to Bank transfers (A/C holders) from the date of remittance.

b-Telex Transfer (T.T): Telex Transfers (Cash Collection / Bank to Bank) will be considered as paid unless reported otherwise by the remitter within one month from the date of remittance.

This company will not accept any Inquiries unless within the above time limitation.

4 If it is required, Proof of Payment (requested by the remitter or for any other reason) will be provided by this company from its correspondent whenever possible and after receiving the required deposit from the remitter. The remitter will be responsible for all charges/expenses in the process (provided) that the time limitation in item (3) above is met).

5-Transfers (T.T. /TRF) are processed in the country of destination according to the beneficiaries details given by the remitters. If any transfer is not executed by any of our corre spondents due to improper beneficiary details, the responsibility of late payment, Stop Payment / Refund charges, and Amendment charges will rely on the remitter if incorrect details are given by the remitter (provided that item (3) of these conditions is met.).

6-This company will not accept any responsibilities if transfers are delayed by any of its correspondents for any reason.

7- This company will not be held responsible, if any transfer (TT/TRF) was not executed by this company correspondents due to reasons beyond this company control such as beneficiary's A/C being closed or for legal reasons, etc. ...... or due to the current situations at destination. However, if this company is able to revert funds from its correspondents, it will either resend these funds to a new address given by the remitter or the remitter will be refunded in U.A.E. Dirhams (provided that item (3) of these conditions is met.).

8-All company Terms and Conditions such as Terms & Conditions for Change of Beneficiary Details forms, for Transfer Refund forms, and all the Terms and Conditions which are set in the back side of this transaction will be applicable, if change of beneficiary details or refund of a transfer is requested by any remitter.

9-Monetary Laws of the U.A.E, and / or the Intermediate countries and / or the destination countries will be applicable to all transfers, (T.T/TRF) purchased from this company. Transfers (T.T/TRF) might be delayed, seized or frozen by the said authorities if found suspicious. It is the sole responsibility of the remitter to co-operate with this company and the concerned authorities by providing them with any additional information, documentation, identification or any other proofs whenever required. This company will not be liable (directly or indirectly) for transfers (T.T/TRF) being delayed, seized, frozen or for any losses incurred in the process.

10- If a remitter paid a cheque against a purchase of any transfer, the transfer will not be executed unless and until the cheque is encashed. If the cheque is returned for any reason, this company has the right to cancel the transfer, take any legal action against the remitter and hold the remitter responsible for all expenses in the process.

11- In the event of any inconsistency between the two texts (Arabic & English) for the above Terms Conditions, the Arabic version will overrule.

Currency rates keep fluctuating and rates shown here are indicative only.

Please connect with our nearest branch or call 600541118 for more informations.